fremont ca sales tax rate 2019

The current sales tax rate in Fremont is 925 but their computer has been charging people at 975. A City county and municipal rates vary.

Why Households Need 300 000 To Live A Middle Class Lifestyle

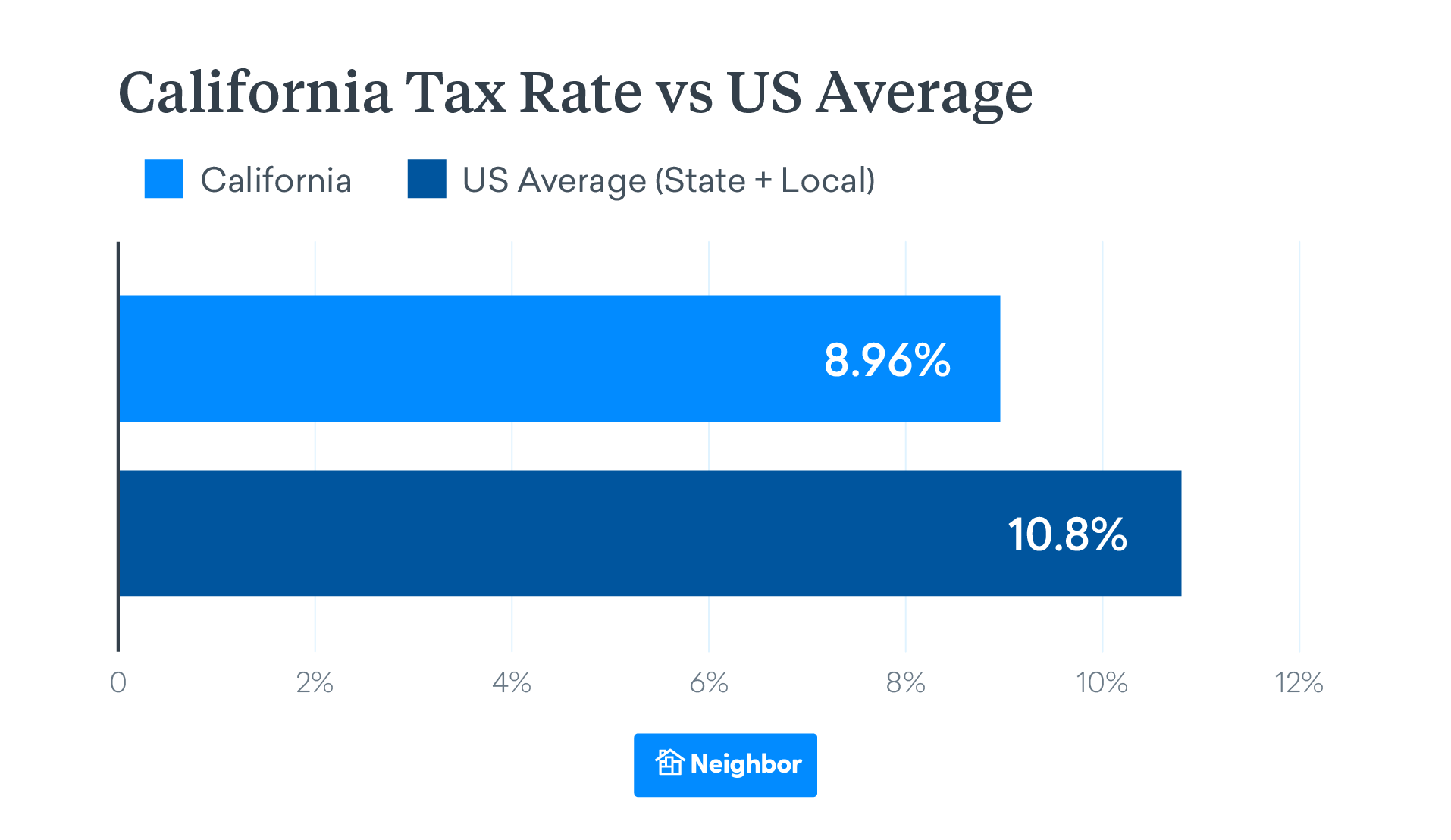

California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35.

. Anaheim CA Sales Tax Rate. This is the total of state county and city sales tax rates. 4 rows Rate.

1788 rows California Department of Tax and Fee Administration Cities. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Wayfair Inc affect California.

The County sales tax rate is. The District of Columbias sales tax rate increased to 6 percent from 575 percent. 127 rows Table 1.

You can print a 1025 sales tax table here. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Camino 7250 El Dorado Camp Beale 7250 Yuba Camp Connell 7250 Calaveras Camp Curry 7750 Mariposa Camp Kaweah 7750 Tulare Camp Meeker 8125 Sonoma Camp Nelson 7750 Tulare Camp Pendleton 7750 San Diego. Real property tax on median home.

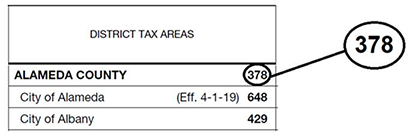

Some areas may have more than one district tax in effect. This is the total of state county and city sales tax rates. City sales and use tax rate changes Alameda Alameda County.

There is no applicable city tax. The Fremont sales tax rate is. You can print a 1025 sales tax table here.

Average Sales Tax With Local. You can print a 6 sales tax table here. B Three states levy mandatory statewide local add-on sales taxes at the state level.

2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be. Sales tax fremont ca 2019 Tuesday July 26 2022 Edit. Battalion Chief Fremont 2019.

Those district tax rates range from 010 to 100. The 7 sales tax rate in Fremont consists of 6 Iowa state sales tax and 1 Mahaska County sales tax. The Fremont Valley sales tax rate is.

These rates are weighted by population to compute an average local tax rate. If in Fremont County. There is no applicable county tax city tax or special tax.

Did South Dakota v. There are a total of 469 local tax jurisdictions across the state collecting an average local tax of 2613. California Sales Tax Rates By City County 2022 How To File And Pay Sales Tax In California Taxvalet.

From 925 to 975. Three cities follow with combined rates of 10 percent or higher. The 6 sales tax rate in Fremont consists of 6 Michigan state sales tax.

Bakersfield CA Sales Tax Rate. Many local sales and use tax rate changes take effect on April 1 2019 in California as befits its size. The minimum combined 2022 sales tax rate for Fremont California is.

The California sales tax rate is currently. County 25 Total 54. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Fremont collects the maximum legal local sales tax. There is no applicable city tax. The statewide tax rate is 725.

FREE Tax Training 2022 - Tax Consultant Course - Become Certified Tax Consultant - Try Now. The minimum combined 2022 sales tax rate for Fremont Valley California is. The County sales tax rate is.

California Franchise Tax Board Certification date July 1 2021. Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent. The California sales tax rate is currently.

100118 033119. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent. Ad Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022.

The California sales tax rate is currently. Canon City 30 Effective 1-1-2017 Total 84. 41850 Higgins Way Fremont Ca 94539 Mls 40856209 Redfin How To File And Pay Sales Tax In California Taxvalet.

The 1025 sales tax rate in Fremont consists of 6 California state sales tax 025 Alameda County sales tax and 4 Special tax. If in Canon City Limits. Sales Tax State Local Sales Tax on Food.

Food And Sales Tax 2020 In California Heather Fremont CA Sales Tax Rate The current total local sales tax rate in Fremont CA is 10250. State Local Sales Tax Rates as of January 1 2019. California 1 Utah 125 and Virginia 1.

The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. If in Florence City Limits. For tax rates in other cities see Michigan sales taxes by city and county.

California Used Car Sales Tax Fees 2020 Everquote

California Sales Tax Rates By City County 2022

All About California Sales Tax Smartasset

California Sales Tax Rates By City

California Sales Tax Guide For Businesses

Food And Sales Tax 2020 In California Heather

Moving To California Neighbor Blog

What Us City Has The Highest Hotel Tax Quora

Information For Local Jurisdictions And Districts

Food And Sales Tax 2020 In California Heather

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

All About California Sales Tax Smartasset

File Sales Tax By County Webp Wikimedia Commons

Food And Sales Tax 2020 In California Heather